On August 18, the 2022 China Baoding Capital Conference with the theme of "Innovation Drives Development, Capital Empowers the Future" opened at Baoding Electric Valley International Hotel. Professor Zhang Jun, a senior professor of liberal arts at Fudan University and dean of the School of Economics, delivered a keynote speech at the conference forum. This article is modified by Professor Zhang Jun based on the live speech.

Zhang Jun:

Distinguished guests and leaders, good morning. I am very happy to attend the conference. Since it is a capital conference, I think I should talk a little about capital. I hope that capital and the development of China's economy in the next 30 years can be linked together.

China has gone through 40 years from the 1980s to the present. I regard it as a stage where we are rapidly catching up, but now we have entered a post-catch-up period, and the external geopolitics has undergone great changes. Objectively It is required that the Chinese economy should turn to more endogenous development forces to promote economic development. In this case, the role of capital needs to be considered.

First of all, I would like to recommend a book, The Secret of Capital written by Peruvian economist Hernando de Soto. This book was translated into Chinese ten years ago, and there were many comments in the academic circle at that time. . The author of this book and his team went to many developing countries and ex-socialist countries, and they found that the assets accumulated in these countries are not as small as we thought, but these assets have no way to become capital, just a rigid asset , in other words, they cannot be turned into productive forces, which is the main reason why they cannot develop the economy well.

Why can't it become productive? The author's research found that a common problem in these countries is that these assets cannot enter a system of officially recognized and protected ownership, which is also a legal system. Without access to the officially recognized ownership system, like farmers in China today, their land assets cannot be used for financing, cannot be liquid, and cannot be mortgaged.

This is indeed the situation in many developing countries. Although there have been decades or even hundreds of years of asset accumulation, in fact, what can really be defined as capital is still a very small part of it, and most of them are still excluded from the formal ownership system. Besides, this is probably a common feature of developing countries, including former socialist countries. This secret was discovered by the author, so I wrote such a book, in which there are a few golden sentences to share with you.

First, capital is a right, a right to decide how to use one's own capital; rights must be recognized, respected and protected by law. Today we say that property rights should be protected by law, which is very important for long-term economic development and how capital can exert its own capabilities. I wrote a book called "Modern Property Economics" 30 years ago to talk about this. Property rights are very important.

Furthermore, the authors say, good law should be an acknowledgement of reality, not the other way around. Developing countries have a lot of economic activities or property acquired by individuals, which is not actually recognized by law, which is very problematic. The law must be able to accommodate these properties and give them legitimacy, in order to encourage more capital to enter the process of economic development. The author's view on this issue is that all good law recognizes reality and not the other way around.

They use a large number of cases in Western history, such as the case of land occupation by early pioneers in the United States, to illustrate that although land was originally not owned, and many people occupied it first, if this issue is not recognized by law for a long time and protection, it will continue to hinder subsequent economic development, because more capital cannot be formed. Therefore, the property rights system must accommodate some informal but long-existing economic activities or realities in order to clear the obstacles to economic development.

I would like to add another sentence here. In fact, capital should not only be protected and respected as a right, but also the ability to discover entrepreneurs, which is not covered in this book. In fact, this ability of capital can be seen more clearly in the two categories of activity that economists distinguish. A class of activities we can call "first-order activities", the real first-order activities, such as production, division of labor, cooperation, trade, technological and institutional innovation, productivity, human capital development, etc., these activities require more capital and The input of resources, it can be said that capital is the creator of "first-order activities". State or political activity can sometimes help create first-order activity, but is often the creator of "second-order activity." For example, restrictions on transactions (trade), regulations, approvals, licenses, discrimination, corruption, taxes and subsidies, monopolies and cartels (note: economic terms, monopoly forms of organization), etc., are all second-order activities.

The first-order activity is the activity of making a big cake, and the second-order activity is the activity of sharing the cake. In any economic development phenomenon, there is an interaction between these two activities. National actions or political actions are often more typical second-order activities, concerned with how to make a piece of the pie bigger, while capital makes the whole pie bigger.

Although conceptually this distinction can be made, in practice the activities of capital are often influenced and interfered with by state or political actions. For economic development, the key question is whether political action is appropriate or whether it promotes or hinders the first-order activity of capital. In particular, in the early stage of economic development of a country, if the second-order activities cannot be well suppressed, then the country's economy cannot develop. Therefore, in the early days of China's reform and opening up, one of the things that Mr. Deng Xiaoping did was to control or restrict second-order activities, delegating power and giving up profits, so that first-order activities would gradually lead the development of the economy.

Most countries are unsuccessful in economic development, not only because of insufficient capital, but more likely because of the prevalence of second-order activities. China and a very small number of East Asian economies can successfully achieve economic development, largely because of the history and national traditions of East Asian political elites, so that the government can often effectively control second-order activities in the early stages of economic development, so as to formulate policies that are conducive to economic development. policies and strategies. China's successful economic catch-up since 1978 clearly has something to do with it.

The same is true for China and the high-growth economies in East Asia. Of course, what is most lacking in the catch-up stage is capital, but capital can be accumulated and transformed from economic surplus. The key question is whether it is possible to control the second-order activities, so that the government can generate more and more More reform policies and development strategies in favor of first-order activities.

At the beginning of our reform, although we have not established a market economy system in China and lacked the ability to allocate resources effectively, we have tried to use the Western-led global trade system from the very beginning of our strategy to attract foreign investment to set up processing trade in some coastal areas. To participate in global economy and trade, to make good use of China's demographic dividend, and to accumulate capital little by little. China's economic miracle is not easy, it really depends on the efforts of each and every one of us. Because the country is not a market economy, there is no capital, and there is no innovation capability. The only thing that exists is those idle resources. Therefore, if it was able to integrate into the Western trading system and gradually release its demographic dividend by participating in global trade, the economy would develop slowly, and economic surplus would gradually accumulate, and only with surplus would it be necessary to convert it into capital.

Looking back on the process of the past 40 years, China's economic catch-up is really remarkable. Most developing countries cannot do this because they do not have the elite political traditions of ours and East Asian economies, the national capacity is weak, and the government is benefited. Group kidnapping, second-order activities are rampant. In India, for example, second-order activities still dominate the country's economy today. First-order activity cannot defeat second-order activity, which is why many countries cannot even get out of the low-income trap.

In fact, as long as there are second-order activities, there will be traps not only in the low-income stage, but even in the middle-income stage. We have entered the late stage of the middle and high-income stage today, and we are about to cross the threshold of high-income countries. We have more abundant capital today than young labor, and the relative prices of capital and labor begin to change. With the improvement of the level of capital accumulation, the ability of capital to discover entrepreneurs and create value has also been greatly improved. The economy is entering the stage of post-catch-up or autonomous growth from the catch-up stage, and capital surplus has become the most important endowment condition in our post-catch-up stage.

At this time, whether the country can properly handle the relationship between political activities and capital, and how to ensure that capital can better utilize its ability to identify entrepreneurs and create value, so as to use capital more effectively, becomes the key to success in the independent growth stage.

In this regard, I will briefly share my views. In my opinion, how to make better use of capital is crucial to whether China's economy can achieve the second centenary goal in the next 30 years. Economics tells us that the effective allocation of capital depends on whether capital can be found and entered into more productive economic activities. This, of course, can only be achieved in a freer market economy system.

Recently, a team from the University of St Gallen in Switzerland compiled the Political Elite Index (EQx) of more than 100 countries around the world. The construction of the index is based on more than 150 variables related to political activity and economic development. The magnitude of the index reflects whether the country's political activity is more conducive to promoting, rather than hindering, economic growth. Among all the higher-ranking countries, China is one of the very few developing countries. This first shows that Chinese politics has done a good job of suppressing second-order activity.

Indeed, if I compare the political elite index of the major economies with their respective GDP per capita (measured in terms of the purchasing power of US dollars), we see that the political elite index does show a strictly positive relationship with GDP per capita (see Figure 1)

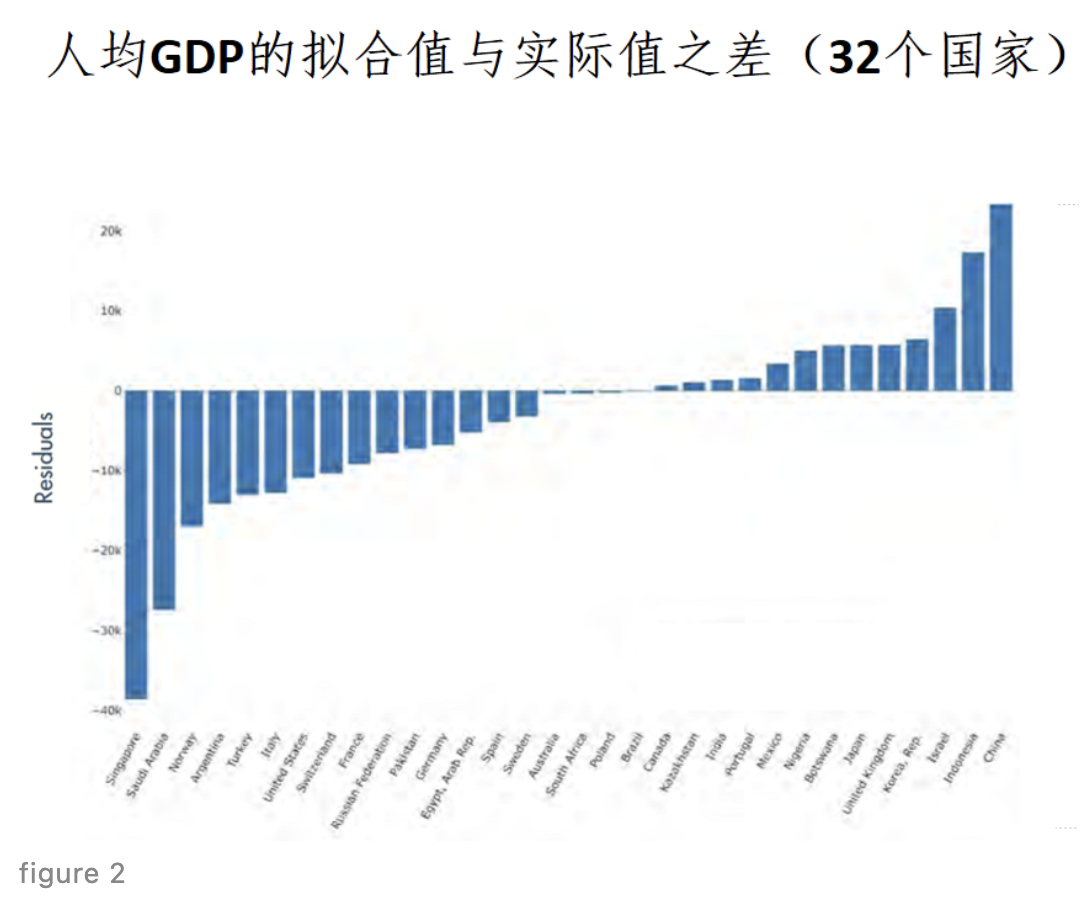

Then, we use this graph to make a transformation, and we can discover more meanings. For example, we can calculate the vertical distance between each point in the above figure and the fitted trend line as a new ordinate, and then put it together with the political elite index and convert it into another figure, which can be particularly vivid. See an interesting phenomenon.

In Figure 2, the ordinate is the vertical distance between the point represented by each economy in Figure 1 and the trend line, that is, the difference between the fitted value of GDP per capita in this economy and the actual value. We see that this value in China is positive and very large, while Singapore is negative and very large. What does that mean? It refers to the fact that, given the quality of China's political elite, China should have achieved a higher per capita GDP than it is now, but is now less than what it should have achieved. Singapore, on the other hand, has a much higher GDP per capita than it should be, given its level of political governance.

So, Figure 2 gives us the space we can imagine. Think about it, why, given the quality of China's political elites, China's per capita GDP should actually be higher. This may be one of our potentials that needs to be further realized. What is the realization of this potential? Since the quality of China's political elites is already quite high, and there is not much room for further improvement, what is the main reason for the future growth of per capita GDP? I think it must be possible to start from another space, and this is undoubtedly related to capital.

Today, we have a large amount of assets and wealth in our economy, and capital accumulation has reached quite high levels. This is probably almost the only room for improvement. Capital represents the market, represents productivity, and capital can discover entrepreneurs and innovation capabilities. Under this circumstance, how to crack the secret of capital, better protect the rights and interests of capital and promote the productivity of capital is very important to realize independent economic growth in the post-catch-up period.

To further unleash the productivity of capital, not only a high level of political elite governance is required, but also an ever-improving market economic system to ensure a pro-business and free business and investment environment, so I say the direction of China’s economic reform is very high. To be clear, in order to achieve the second centenary goal, apart from the continuous modernization of political elite governance, the only thing with huge potential room for improvement is the degree of marketization of the economy. As long as we persist in and step up the promotion of reform and opening up, the level of economic marketization can be improved, and the space for capital to discover entrepreneurs and innovation capabilities will continue to expand. The result is a continuous increase in productivity.

Today, we are faced with a large number of institutional and institutional obstacles to the effective allocation of capital, which requires China to continue to deepen reform and opening up, and constantly eliminate the negative impact that hinders the effective allocation of capital, so as to greatly improve the overall level of liberalization of the Chinese economy.

In this context, I think that our real per capita GDP level can be greatly improved without the need for more resource investment. As long as we can clearly understand the heights we have reached, what is difficult to improve, and where there is real room for improvement in the future, we can better formulate policies and strategies, and find a feasible path to continuously reduce China and the frontier economy. productivity gaps between individuals and into the ranks of advanced high-income countries as defined by our second centenary goal.

'World News' 카테고리의 다른 글

| 15 health care tips, be more healthy (0) | 2022.08.30 |

|---|---|

| Alzheimer's disease can be prevented, and these strategies need to be mastered! (0) | 2022.08.29 |

| The future of China's economy (0) | 2022.08.28 |

| Is Russian gas still sustainable? (0) | 2022.08.28 |

| These six points determine the future of China's economy! (0) | 2022.08.27 |